Payday loans are designed to provide borrowers short-term cash for emergency needs. Normally, the cash is used to keep services on, pay for car repairs, avoid bounced checks and overdraft fees, or take care of expenses that simply can not wait until the next pay period. But, it is important that before you apply for a loan, you understand how to borrow responsibly in order to avoid even more financial trouble.

5 Tips for Smooth Borrowing

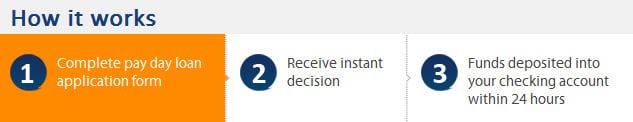

(1) Find the best terms and rates: In order to find the best terms and rates, you need to shop around and compare offers from different lenders. Now you could do all that legwork yourself or you can access our lending network. With one easy application, your information gets processed to the appropriate lenders, who will then provide you with free quotes. Then you can review the offers and choose the one that has the best terms and lowest rates.

(2) Only use payday loans for necessities: Some things just can’t wait until your next paycheck, but other things can. So make sure you carefully evaluate your needs before you apply for a loan. Urgent matters might include include car repairs so you can continue to go to work, utility or phone payments so you don’t incur cutoff or reconnect fees or even groceries to feed your family. You don’t want to waste the money and then find yourself in a situation where you are unable to pay back the loan in two weeks with your next paycheck.

(3) Read documentation carefully: When you get a loan, you are making a commitment. The documentation you receive spells out your commitment in clear terms. It is important that you understand exactly what you are obligating yourself to. You should review fees, rates, and due dates, as well as late fees and extension terms. If you have any questions, ask your lender to explain it. If they will not, move on to another lender.

(4) Plan to pay your loan back on time: Most of the criticism towards payday lending results from the fact that some borrowers carry these loans for long periods of time. This causes them to pay high rates and fees over the course of the loan. When you obtain a loan, you need a plan to pay it back by your next pay period. A payday loan is buying you some time, but if you don’t get a part-time job, sell something or cut back on unnecessary spending you will be in the same situation when you get your next check.

(5) Improve your credit: Emergencies happen and when they do, a payday loan can help you out even if you have bad or poor credit. But, take this as an opportunity to get your finances back on the right track. If you pay your loan back on time, it will positively impact your credit. You can also take these steps to improve your credit so that you can qualify for lower cost loans next time you need some extra money.

• You can correct any inaccuracies on your credit report.

• Use less than 30 percent of your available credit.

• Pay your bills on time, especially installment and revolving debt, such as credit cards, auto loans and mortgages.

A payday loan is your opportunity to show that you can act responsibly with your money. By following these 5 steps, you will not only be able to find a loan at the best terms and rates, but also putting yourself in a better financial situation for the future.